NEWS

NEWS

Faurecia and Hella are combined to create the 7th largest supplier of automotive components around the world

21-08-2021

In August,the Germany lighting specialist HELLA and French automotive supplier Faurecia signed an agreement on the combined group of the two companies.

During the transaction, Faurecia will acquire the 60 percent stake held by HELLA pool shareholders. In addition, Faurecia has announced a voluntary public tender offer to acquire the remaining HELLA shares at an offer price of € 60 per share (gross offer price of € 60.96 including the expected dividend of € 0.96 per HELLA share). The closing of the transaction is subject to regulatory approvals and is expected in early 2022.

In doing, HELLA and Faurecia will become the 7th largest global automotive supplier. This makes it possible to achieve further profitable growth. HELLA and Faurecia today already are global market leaders in their respective fields. After their combination, the combined group will focus on the following areas that go along with the industry trends.

Electric Mobility (incl. hydrogen solutions),

ADAS & Autonomous Driving,

Cockpit of the Future,

Lifecycle Value Management.

The transaction is expected to be concluded earlier 2022. The capital market is much optimistic of the combined group with expected ambition for strong sales performance, best profitability and €5.5bn net cash flow.

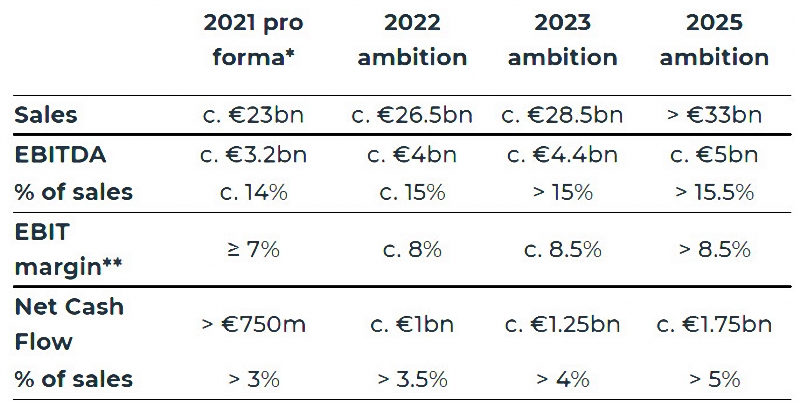

Based on public targets announced by both companies at their separate capital markets day,cost synergies and optimization, investors demonstrate their following financial metrics estimation from the year 2022 to 2025.

1)Strong sales volume up to more than €33bn in the year 2025, broadly doubling the market’s average growth,

2) The best profitability with an EBITDA margin above 15.5% and an operating margin above 8.5% in the year 2025, much better than their individual financial data before combination;

3) Strong cash generation,the net cash flow up to €1bn in 2022 and achieving above 5% of sales in the year 2025.

During the transaction, Faurecia will acquire the 60 percent stake held by HELLA pool shareholders. In addition, Faurecia has announced a voluntary public tender offer to acquire the remaining HELLA shares at an offer price of € 60 per share (gross offer price of € 60.96 including the expected dividend of € 0.96 per HELLA share). The closing of the transaction is subject to regulatory approvals and is expected in early 2022.

In doing, HELLA and Faurecia will become the 7th largest global automotive supplier. This makes it possible to achieve further profitable growth. HELLA and Faurecia today already are global market leaders in their respective fields. After their combination, the combined group will focus on the following areas that go along with the industry trends.

Electric Mobility (incl. hydrogen solutions),

ADAS & Autonomous Driving,

Cockpit of the Future,

Lifecycle Value Management.

The transaction is expected to be concluded earlier 2022. The capital market is much optimistic of the combined group with expected ambition for strong sales performance, best profitability and €5.5bn net cash flow.

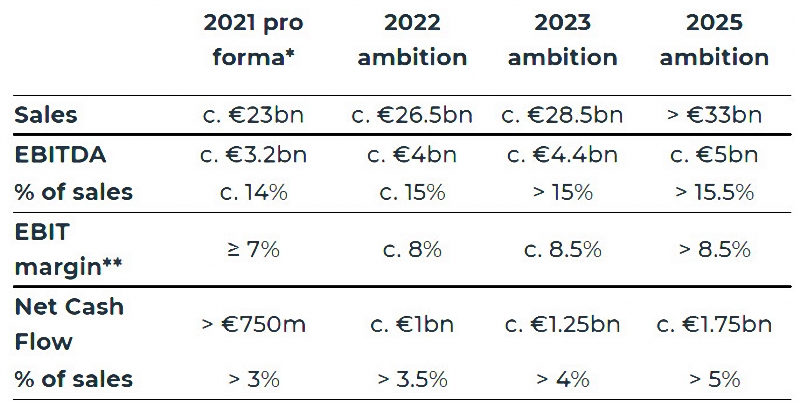

Based on public targets announced by both companies at their separate capital markets day,cost synergies and optimization, investors demonstrate their following financial metrics estimation from the year 2022 to 2025.

1)Strong sales volume up to more than €33bn in the year 2025, broadly doubling the market’s average growth,

2) The best profitability with an EBITDA margin above 15.5% and an operating margin above 8.5% in the year 2025, much better than their individual financial data before combination;

3) Strong cash generation,the net cash flow up to €1bn in 2022 and achieving above 5% of sales in the year 2025.